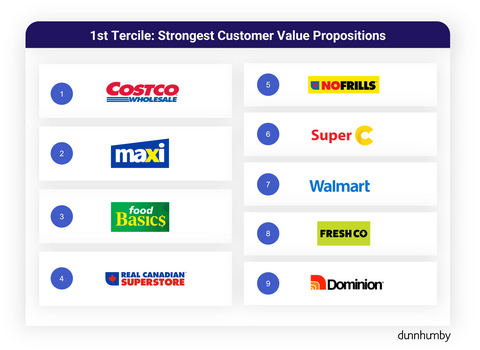

dunnhumby, a global leader in customer data science, has named Costco as Canada’s top grocery retailer for the second consecutive year in the dunnhumby Retailer Preference Index (RPI) for Canada. The nationwide brand equity study examines the $115 billion Canadian grocery market by analyzing customer and financial data for the 28 largest conventional, discount, superstore, and club banners in Canada, which represent 97% of market share. Maxi, Food Basics and Real Canadian Superstore followed Costco as the top four grocery retailers. No Frills, Super C, Walmart, Fresh Co, and Dominion round out the top nine.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20251210698910/en/

The First Tercile from the 2025 dunnhumby Retailer Preference Index (RPI) for Canada

The top nine grocers in the RPI, almost entirely club, discount, and superstore formats, lead in saving Canadians money (price, promotions, and rewards)— the most important pillar for Canadian consumers in the RPI. This pillar drives 44% of financial and customer results. Retailers who have a competitive advantage in this pillar are more likely to achieve long-term success.

“Even though inflation and interest rates have dropped, Canadians still face affordability issues and are focused on value and savings more than last year,” said Matt O’Grady, dunnhumby’s President of the Americas. “This RPI report gives retailers important data and insights to adjust their customer strategies and offerings to better help their customers meet their needs.”

Key findings from the study:

- Maxi overtook Costco as the top grocery retailer in Quebec, the country’s second-most populous province. The retailer surpassed Costco in this province by demonstrating superior performance in pricing, promotional strategies, and overall savings, the most important customer perception pillar for Quebec consumers. Maxi also outpaces Costco on speed and convenience – the fourth most important pillar.

- The top nine Canadian grocers (first tercile) are growing significantly faster. The top tercile retailers led grocery revenue growth both in the past year and over the last five years, gaining a clear market share advantage. Over the long term, they grew two times faster than the lowest-ranked retailers

- First tercile retailers capture 29% of a customer's grocery spend, while third tercile retailers capture 17%.

- Assortment quality (31%) and Digital (11%) are the second and third most associated pillars for long-term success, but their decline in 2025 indicates that Canadians are trading-off benefits for better savings in their grocery purchases. The remaining two pillars are Speed and Convenience (8%), and operational consistency (6%).

- The best performing conventional retailers (Zehrs Markets, Save-on-Foods, Safeway, Thrifty Foods) compensate for their price / promotions disadvantages in several ways. They deliver targeted savings through optimized loyalty programs, make promotions more relevant and personalized, and offer adequate quality without overinvesting. This approach ensures they remain competitive on base prices.

- Retailers should keep an eye on Amazon, as 30% of Canadian customers buy groceries there. Amazon is not listed in the RPI due to its lack of physical stores in Canada, but it would rank eighth if included, down from second last year. The lower ranking stems from higher pricing and shifting priorities in 2025. Despite this, Amazon remains a potential competitor, especially in perishables, given its large customer base and strong market presence.

Methodology

The dunnhumby RPI is the only approach to ranking grocers that combines financial results with customer perception. For this RPI, dunnhumby analyzed customer and financial data for the 28 largest conventional, discount, superstore, and club banners in Canada, which account for 97% of market share in those formats. The customer perception data comes from dunnhumby’s survey of 6,000 Canadian grocery shoppers. Financial data analyzed included market share, near-term, and long-term sales growth.

The RPI is available for download today. Retailers featured in the RPI who wish to receive their specific banner profiles can speak with their dunnhumby account executive or reach out to dunnhumby at: https://www.dunnhumby.com/contact/. dunnhumby will also be attending and exhibiting at NRF 2026 in booth #4665.

About dunnhumby

dunnhumby helps businesses grow through faster, better decision-making, as the essential intelligence layer connecting the world’s leading retailers and brands.

Sitting at the intersection of loyalty, media, and category management, dunnhumby, helps to navigate complex and competing priorities. Combining AI-enabled science, software, trusted advice, and 35+ years of dedicated retail experience, dunnhumby is recognized as a leader in connecting customer insight and action to build loyalty, drive performance, and deliver results that last.

With offices in locations across Europe, Asia, Africa, and the Americas, dunnhumby works with brands including Tesco, Coca-Cola, Meijer, Procter & Gamble, and L’Oreal, to make smarter decisions today and tomorrow.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251210698910/en/