Today's update from YMC moves Birch to the top of the list with the early indications from ongoing diamond drilling demonstrating considerable scale potential.

Robert Sinn

Sep 03, 2025

The Birch Project has looked highly prospective from day one, when I opened the YMC presentation for the first time. This morning’s news release from Yukon Metals (CSE:YMC, OTC:YMMCF) adds another level of confirmation to its prospectivity. Birch sits in the Yukon-Tanana Terrane, a favorable package of carbonaceous schists, quartzite, marbles, amphibolite, and porphyritic intrusives. Mineralization occurs along marble–schist contacts and intrusive margins, consistent with large, multi-stage skarn systems.

Disseminated on behalf of Yukon Metals Corp.

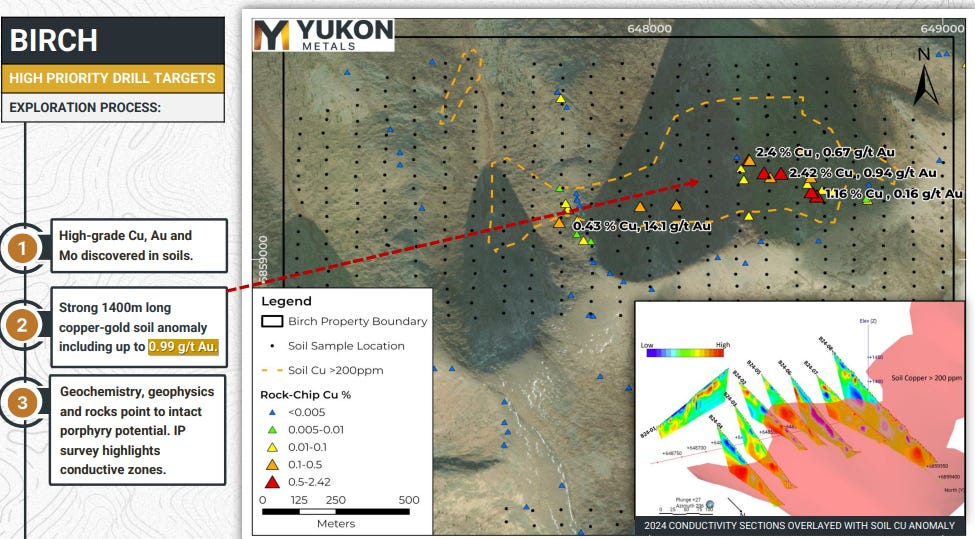

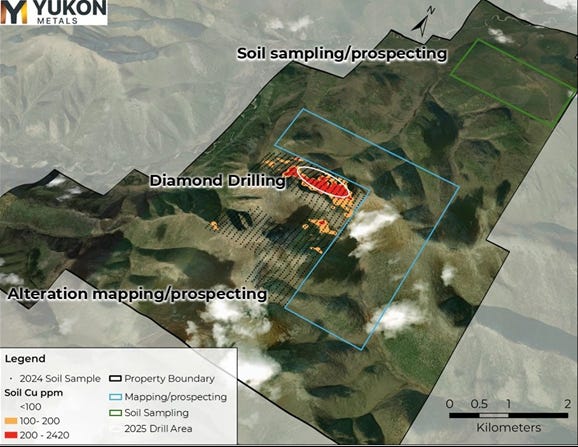

The first thing that caught my attention at Birch is the soil anomaly; the scale (1,400 meters strike extent) and tenor (up to .99 g/t gold and .24% copper) of the copper-gold soil anomaly at Birch is impressive:

As seen in the IP geophysics sections above, there is also an apparent conductive anomaly beneath the surface copper-gold anomaly. The strength of copper, gold, and molybdenum in soils over such a widespread area combined with a conductive signature at depth calls for a core drilling program to investigate what could be driving the mineralization to surface.

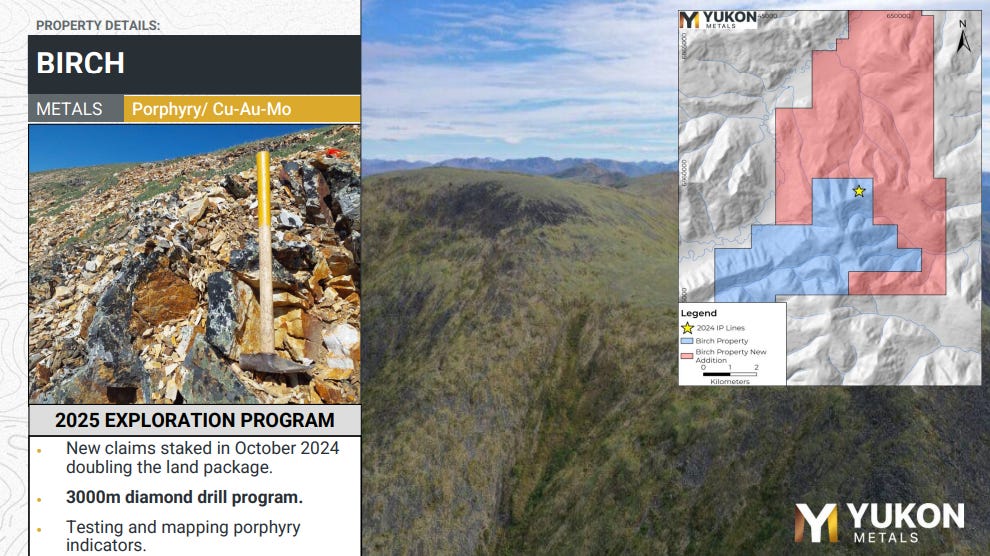

Based upon the strength of the surface sampling and IP lines, in October 2024 YMC decided to more than double the size of the Birch claims package:

The mineralization described in the first three holes at Birch is associated with felsic and porphyritic dykes, suggesting potential linkage to deeper intrusive sources. Additionally, today’s news release offers evidence of a long-lived hydrothermal system (presence of both prograde and retrograde alteration).

The presence of massive pyrrhotite > chalcopyrite and strong sulfide-bearing skarn horizons at intrusive contacts in hole 25-02 is especially encouraging. In skarn systems, massive pyrrhotite often develops in reduced, iron-rich environments, especially where carbonates interact with mafic to intermediate intrusions (this is the case at Birch). Gold-bearing skarns often show extensive retrograde alteration with chlorite-amphibole.

The discovery of multiple stacked horizons, both near-surface and at depth, indicates a potentially large and laterally extensive skarn system. I’d also note that the sulfide assemblages (pyrrhotite–chalcopyrite dominant) described in the news release are favorable indicators of copper-gold rich skarns.

Zones of sheeted quartz-calcite veining above the skarns in hole 25-01 suggest the potential for a broader hydrothermal footprint. Sheeted quartz(-calcite) veins typically form in the upper parts of porphyry intrusions or along structural conduits where hot hydrothermal fluids moved repeatedly. If such veining occurs above or adjacent to skarn horizons, it implies that the skarn mineralization is part of a broader porphyry hydrothermal cell.

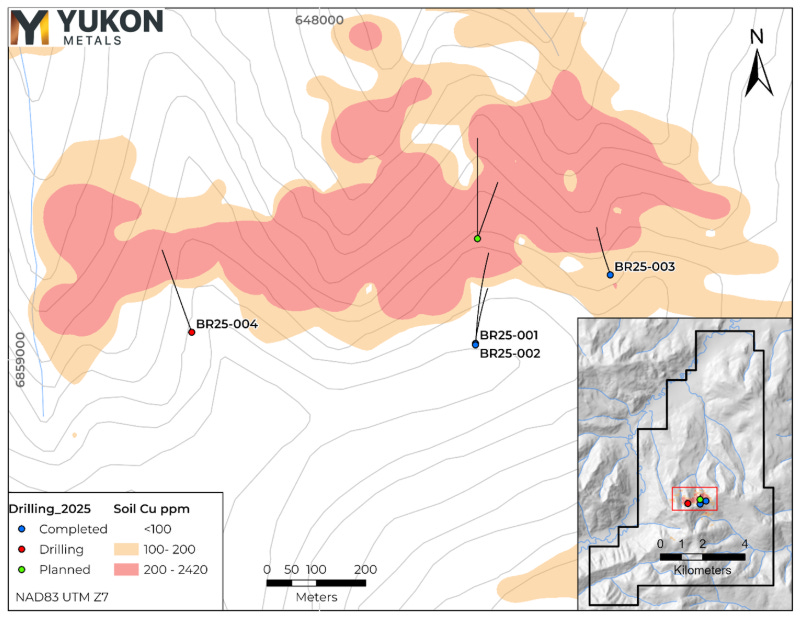

The size of the step-out in hole 25-04 also stands out. This is an aggressive step-out hole 600 meters to the west of holes 25-01 and 25-02. To me, this demonstrates that the Yukon Metals team are committed to demonstrating the scale potential at Birch, and that they have increasing confidence in their geological model (the surface geochemistry and IP is working). Hole 25-04 is following the strategy of targeting marble–schist contacts and intrusive margins. In this case in an area that hosts strong gold anomalies at surface.

If YMC hits in hole 25-004 then watch out, the scale potential grows substantially.

The Birch Project has just become a much more exciting copper-gold exploration target with substantial scale potential. The 2025 drill program has validated the geological model by intersecting wide, mineralized skarn horizons both near-surface and at depth, with evidence of intrusive-related veining and alteration. While assays are pending, the system’s scale, multi-stage development, and strong geochemical anomalies point toward the potential for both:

A large, multi-horizon copper-gold skarn system, and

A possible underlying porphyry copper-gold center driving the mineralization.

The next critical step will be assay confirmation and further drilling to test for continuity, grade distribution, and direct porphyry-style mineralization. Drilling at Birch is ongoing and assays results are pending for the first three holes.

Disclosure: Author owns shares of Yukon Metals and may choose to buy or sell at any time without notice. Yukon Metals Corp. is a sponsor of Goldfinger Capital.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The stocks discussed in this article are high-risk venture stocks and not suitable for most investors. Consult Company SEDAR profiles for important risk disclosures.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.