After nearly two decades in power, the Movement Towards Socialism (MAS) faces what could be the end of its political dominance because in simple terms Bolivia is just broke. Considering the deep political polarization and the possibility that the MAS may be defeated by a new political force, a violent popular uprising mirroring 2019; or even a real coup (unlike the Zúñiga's hoax); is not out of the question. The Bolivian general elections are scheduled for Aug 17th, 2025, with a likely second round on October 19, 2025, if no candidate secures a majority (over 50% or 40% with a 10% lead).

Who are the likely Contenders

The presidential election will most likely be decided in the second round, as both the MAS and the opposition are now divided and the electorate is fragmented. From what is known at this point, the final result will hinge on coalition-building and campaign effectiveness in the coming weeks. The most likely contenders at that stage today are Doria Medina, Jorge Quiroga and Andrónico Rodríguez:

- Samuel Doria Medina (National Unity Front): A millionaire businessman and three-time presidential candidate (2005, 2009, 2014), Doria positions himself as a social democrat, potentially appealing to center-left voters disillusioned with MAS. Recent polls show him leading or tied for the lead.

- Andrónico Rodríguez (Alliance): A 36-year-old Senate president and former Morales protégé and ally, Rodríguez is running with a separate leftist coalition. With deep ties to coca growers and a more moderate tone, he retains grassroots support within MAS’s traditional base.

- Jorge Quiroga (Libre): A former president (2001–2002) and outspoken conservative, Quiroga promotes privatization and a pro-market agenda. His campaign appeals to voters seeking a return to orthodox economic policies.

Both Evo Morales and Luis Arce are out; Morales disqualified by the courts and Arce was sidelined by plummeting popularity. Still, both are backing their "dark horse" candidates, subtly shaping the contest behind the scenes.

Impact on Mining

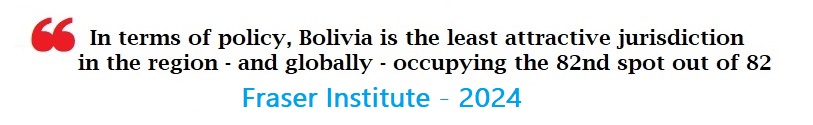

Despite Bolivia's immense mineral wealth, it remains among Latin America’s poorest nations. Mining is arguably the only industry capable of generating the scale of revenue needed to address the country’s economic crisis but let's remember that Bolivia is surrounded by mining countries that aggressively compete for foreign capital.

It won't be easy, it will require constitutional changes, changes to the mining legal framework, and more importantly, a significant change in how the industry operates in Bolivia today. The 2014 Mining and Metallurgy Law (Law No. 535), enacted under Morales, aimed to align the mining sector with Bolivia’s 2009 Constitution ( Article 349 declared resources as state-owned, prioritizing national control over natural resources) that state-centric framework reduced foreign investment and private sector participation, impacting mining competitiveness. As a consequence, Mineral deposits cannot be registered as property by private firms, limiting their use as collateral or assets for financing; cooperatives were banned from partnering directly with private companies, requiring mediation through COMIBOL; Mining Production Contracts Introduced with Law No. 845 (2016) allow private and cooperative actors to operate in COMIBOL areas but mandate economic participation payments to the state, increasing costs.

The way mining cooperatives are taxed must change: The 2014 Mining Law created a dual system in which cooperatives, often informal or semi-formal groups, benefit from significant tax advantages compared to private foreign mining companies. Today, more than 70% of Bolivia’s mining entities are cooperatives, yet the bulk of state revenue still comes from just five large-scale industrial mines. This imbalance has led to a fiscal framework that is clearly unsustainable and structurally unfair.

Attempts to reform the sector have been politically explosive and violent. In 2016, Deputy Interior Minister Rodolfo Illanes was kidnapped and killed by protesting miners after the government proposed modest reforms to enhance regulation, environmental oversight, and taxation. This underscores the intense resistance to change from entrenched interest groups.

Also, Bolivia’s attempts to nationalize and vertically integrate its lithium industry have fallen short. Despite possessing the world’s largest lithium reserves, Bolivia has generated negligible income from this resource. The government's nationalization strategy and the rejection of foreign investment has stalled development and left the country behind peers like Argentina and Chile, both of which have attracted billions in investment through public-private partnerships.

There is a non-negligible risk of country-wide unrest in 2025. Under a peaceful transition of power scenario, it is likely that Samuel Doria Medina and Jorge Quiroga, leading in polls, would create a more favorable long term environment for FDI in mining. Andrónico Rodríguez - perceived as far more pragmatic than Morales - could potentially increase state control, which might pose challenges for foreign miners, though his moderate stance could still allow some foreign participation.

It remains to be seen how each candidate’s policies might balance local control with foreign investment, particularly for lithium, a key resource. Doria-Medina proposes a new mining law and co-management of lithium, likely attracting foreign investment, especially from the U.S., due to his business background and foreign policy shift toward the U.S. While Quiroga advocates for free zones for lithium manufacturing, which could draw foreign investment in value-added industries, benefiting companies with technology and capital.

Broader Reform Agenda

Priorities for Stabilization According to Economist Jaime Dunn, Bolivia’s path to recovery requires structural reforms across the board ( https://www.youtube.com/watch?v=HZDptQ8a3_Q )

1. Reduction of the size of the state

2. Fiscal Rule (max ratio debt to GDP)

3. Tax reform (including changes to mining royalties and taxes)

4. Transformation of customs agencies and export/import procedures

5. Popular capitalism: normalize property transfer

6. Labor reform: flexibility and equity between public and private sectors

7. Independent judiciary

* Judges elected based on merit

8. Free education: end indoctrination

9. Healthcare system reform

10. Free and open financial system

11. Pension reform

12. Wealth creation and promotion of private investment

Tags: #boardroom #Bolivia $ELO $NUAG $APM $CDE $PAAS $CFE $SCZ $PNTR

#copper #tin #lithium #zinc #ag #bismuth #CountryRisk #JurisdictionRisk

Disclaimer: "A week is a long time in politics" therefore my views will evolve as new facts and events are known. This article represent my opinion, and it is not intended as a investment advice, nor is it a recommendation to buy or sell any financial instrument in any of the company/companies hereto mentioned.