The best the Fed could do was 25bps. As expected, officials trimmed interest rates by a quarter point. Two more cuts are projected by the year-end, with just one more likely next year. Let’s break down what that means for your trading.

After months of economic debate, the U.S. Federal Reserve lowered its key interest rate by 25 basis points to a range of 4%-4.25% — the lowest since late 2022.

This was the first cut this year, but hardly a surprise. Markets had already fully priced in the move. But the real twist came when Chair Powell hinted at two additional cuts in 2025. Since the Fed only meets twice more this year, this implies one cut per meeting unless something fundamentally changes.

In the post-meeting statement, Powell noted that President Trump's tariffs are beginning to push up prices, though the "overall effects on economic activity and inflation remain to be seen." On the labour market, he stressed that lower immigration — not tariffs — is constraining worker supply: "There's very little growth, if any, in the supply of workers." Speaking about the housing market, Powell said the rate cut may not move the needle much.

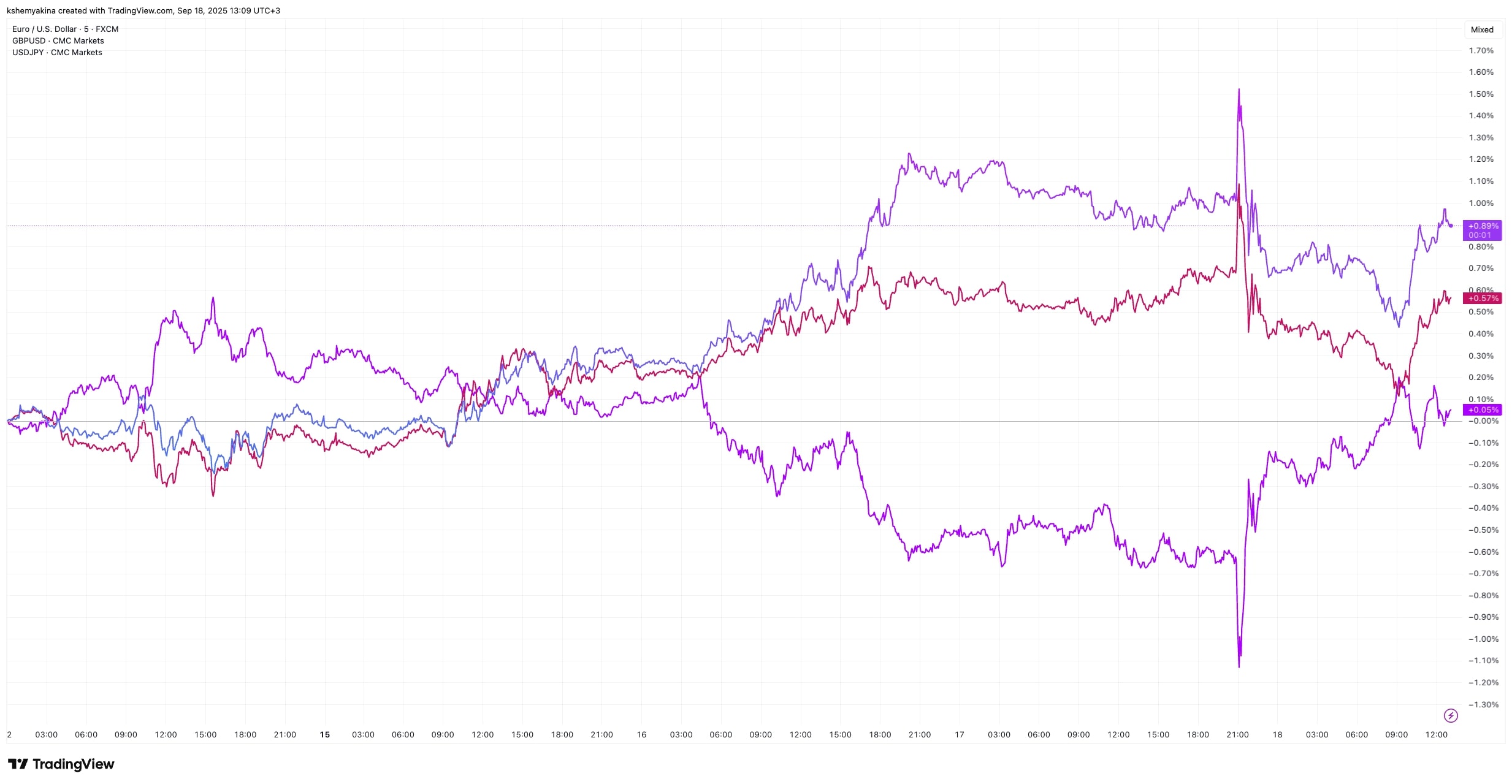

The market reaction was textbook. Lower rates weaken the dollar, and the greenback promptly slipped against major peers. For forex traders, this was no surprise: reduced yields make the dollar less attractive compared to currencies backed by steadier or higher returns.

The EUR/USD surged toward $1.19, its highest in four years. GBP/USD tested $1.37, while USD/JPY fell below ¥146.

But that was the knee-jerk response. By early Thursday the dollar had rebounded — a reminder that markets often overreact before correcting. Still the broader trend looks bearish.

Stocks were less inspired. The S&P 500 hovered near flat, the Nasdaq Composite slipped 0.3% for a second straight decline, and the Dow Jones bucked the trend with a 260-point gain. Why?

Traders had already bought the rumor of rate cuts, piling into equities ahead of time. When Powell delivered exactly what was expected, it wasn’t enough to fuel another rally.

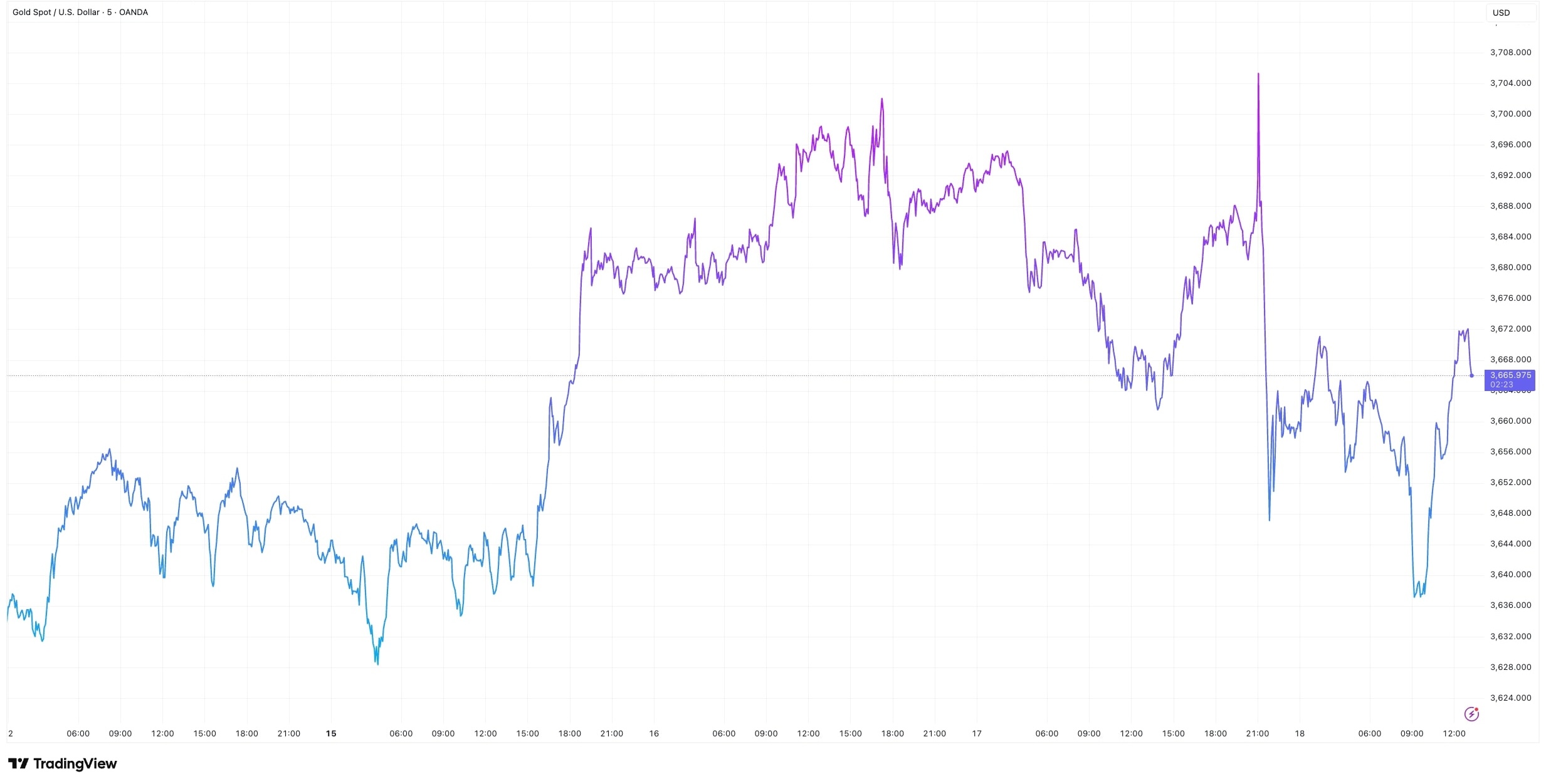

Gold, meanwhile, behaved as it usually does when policy loosens. XAUUSD climbed to the high end of its all-time record of $3,700, before easing back under $3,640.

Inflation, however, remains a problem. Prices have been rising for four months straight with August showing 2.9% annual growth — nearly a full percentage point above the Fed’s 2% target.

That underscores the Fed’s dilemma. Its dual mandate is maximum employment and price stability, but it can’t perfectly balance both. Right now, policymakers appear to be prioritizing jobs, even at the risk of higher inflation.

Economists worry this could evolve into stagflation — a mix of rising unemployment and persistent inflation.

What can lower rates do now? Ideally they’ll encourage businesses to hire, expand, and invest by making credit cheaper. Whether that offsets inflationary pressures is the question traders will keep watching.