2025 Stock Picking Contest Update/PDAC Update

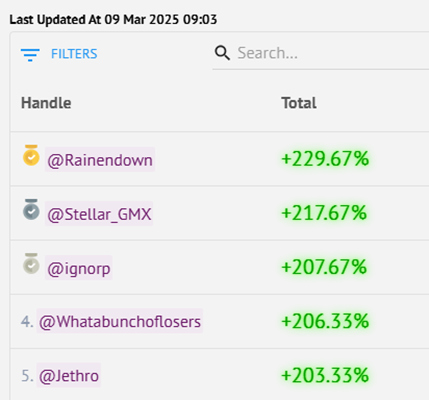

💎 @Rainendown: +229.67% | $HSTR +54%, $IZO +620%, $SONA +15%

📊 @Stellar_GMX: +217.67% | $IZO +620%, $SAM +8%, $TMAS +25%

💥 @ignorp: +207.67% | $FLV.US +5%, $IZO +620%, $TLT -2%

📈 @Whatabunchoflosers: +206.33% | $IZO +620%, $MGRO +3%, $NFG -4%

⚡ @Jethro: +203.33% | $IZO +620%, $MAXX -33%, $QIMC +23%

PDAC just came to a wrap and left us extremely optimistic for the resource sector moving forward (see highlights below). That being said, the small cap getting the most love and carrying our top 5 is in Biotech! Will mining make a comeback by EOY? Will that help topple the IZO lead?

Check out the live leaderboard here: https://ceo.ca/content/contests

#StockPickingContest #Bitcoin #Gold #Silver

PDAC 2025: The Takeaways That Matter

We just wrapped up one of the biggest, baddest, most electric PDAC conferences to date—and the numbers speak for themselves:

27,353 participants.

1,100+ exhibitors.

14.84% growth in attendance over the last three years.

Let’s talk momentum—this wasn’t just another mining convention; this was a statement. With the 3rd highest attendance in PDAC history, we’re looking at a market that’s heating up fast.

You feel that? That’s the early 2010s energy creeping back in. The big money, the big players, the next wave of opportunity—it’s all coming. If you’re not paying attention, you’re already behind.

Junior Mining Stocks Performance Update: March 2025

The junior mining sector is on the move—and if you’re not watching, you’re missing out.

Commodity prices are soaring.

Investor interest is heating up.

Junior miners are making serious moves.

2025 Key Updates:

· Government Policies: Canada extends the 15% mineral exploration tax credit for two years to boost investments. Stricter foreign takeover rules aim to protect domestic mining firms.

Increased IPO Filings: In 2025, 49 new IPOs have already been filed with many more expected to come. Although this is across various sectors, it an indication of a busier IPO market for the remainder of the year.

Cyclical Nature of Junior Mining Stocks: The sector has experienced cycles of exuberance followed by stagnation. Analysis indicates that we are due for a new wave of bullish momentum, with the last significant boom occurring in the late 2010s.

Improved Financing Conditions: A bullish market enhances junior explorers' ability to raise capital at favorable valuations, reducing dilution and enabling more aggressive exploration and development activities.

Commodity vs. Equity Valuation: The S&P GSCI Total Return Index/S&P 500 ratio is near multi-decade lows, indicating that commodities, and by extension, mining equities, are significantly undervalued relative to the broader equity market.

Early 2025 is setting the stage for big opportunities. Gold is pushing record highs, exploration plays are gaining traction, and the smart money is flowing in. This isn’t just a trend - it’s a shift. Get in or get left behind.

Gold Sector:

Price Surge: Gold prices have reached record highs, nearing $2,900 per ounce, driven by economic uncertainties and heightened demand from central banks and retail investors. https://ceo.ca/gold

ETF Performance: Gold mining ETFs have appreciated by approximately 18-19%, with junior gold mining ETFs also achieving double-digit returns. etftrends.com

Analyst Insights: Experts anticipate a potential bull market for junior mining stocks, suggesting that 2025 could mark the beginning of a significant rally in this sector. streetwisereports.com