The Federal Reserve is expected to announce an interest rate cut on Wednesday as it concludes its two-day policy meeting, while also addressing a range of issues that continue to complicate monetary policymaking.

Markets are assigning a nearly 100% probability that the Federal Open Market Committee will approve a second consecutive quarter-point reduction this week. The lending benchmark rate is currently targeted between 4% and 4.25%.

What are the key considerations and what lies ahead for monetary policy?

One major reason officials appear inclined to ease policy is growing concern about the labor market. Even with limited data during the federal shutdown, there are clear signs that inflation is cooling. However, judging by state-level jobless claims that are still ongoing despite the federal shutdown, do not appear to be accelerating. In fact, worries over employment could prompt the Fed to continue cutting rates well into 2026.

Inflation remains well above the central bank’s 2% target. The Bureau of Labor Statistics reported last week, in the only official data release during the shutdown, that the annual inflation rate as measured by the consumer price index remained at 3% in September.

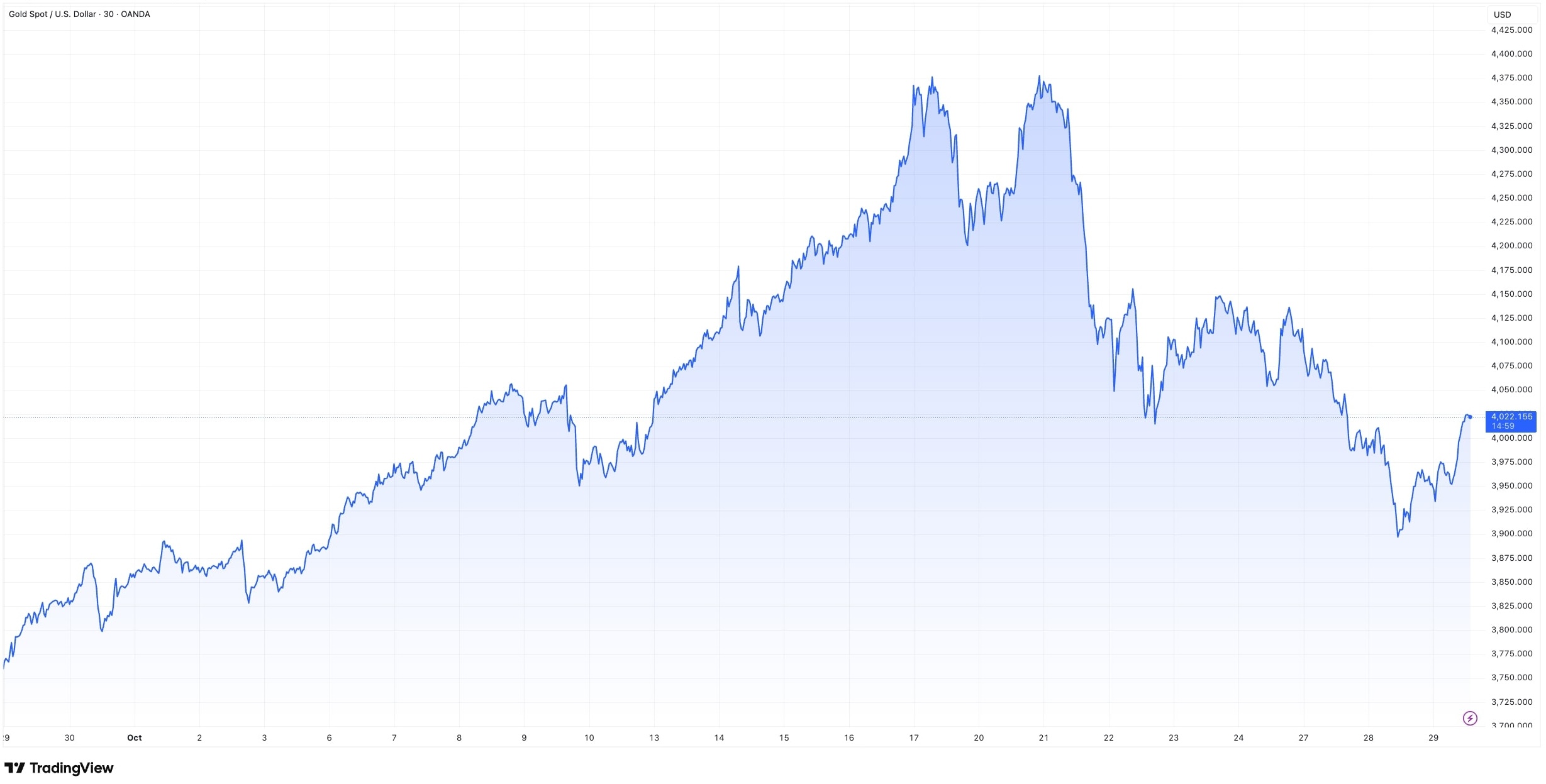

Financial markets have been responding cautiously ahead of the Fed’s decision. Gold steadied after a three-day selloff. Bullion held near $3,950 an ounce, having lost more than 4% over the prior three sessions.

Gold prices have pulled back sharply following a torrid rally that pushed them to a record above $4,380 an ounce last week. Technical indicators suggested the surge had gone too far, too fast, coinciding with reduced demand for safe havens amid signs of progress in US-China trade relations. Even Bitcoin hasn’t matched gold’s recent volatility.

Geopolitical developments are also shaping investor sentiment. With Donald Trump and Chinese President Xi Jinping scheduled to meet on Thursday, Trump told reporters he expects “a very good outcome for our country and for the world.”

The two leaders have not met in person since 2019. Since then, concern in Washington about China’s technological advances, as well as longstanding issues surrounding the U.S.-China trade imbalance, have strained relations between the two superpowers.

According to China's foreign ministry, the upcoming meeting is expected to “inject new momentum into the development of U.S.-China relations." Trump is expected to reduce tariffs on Chinese goods in exchange for Beijing’s commitment to curb exports of precursor chemicals used to make fentanyl.

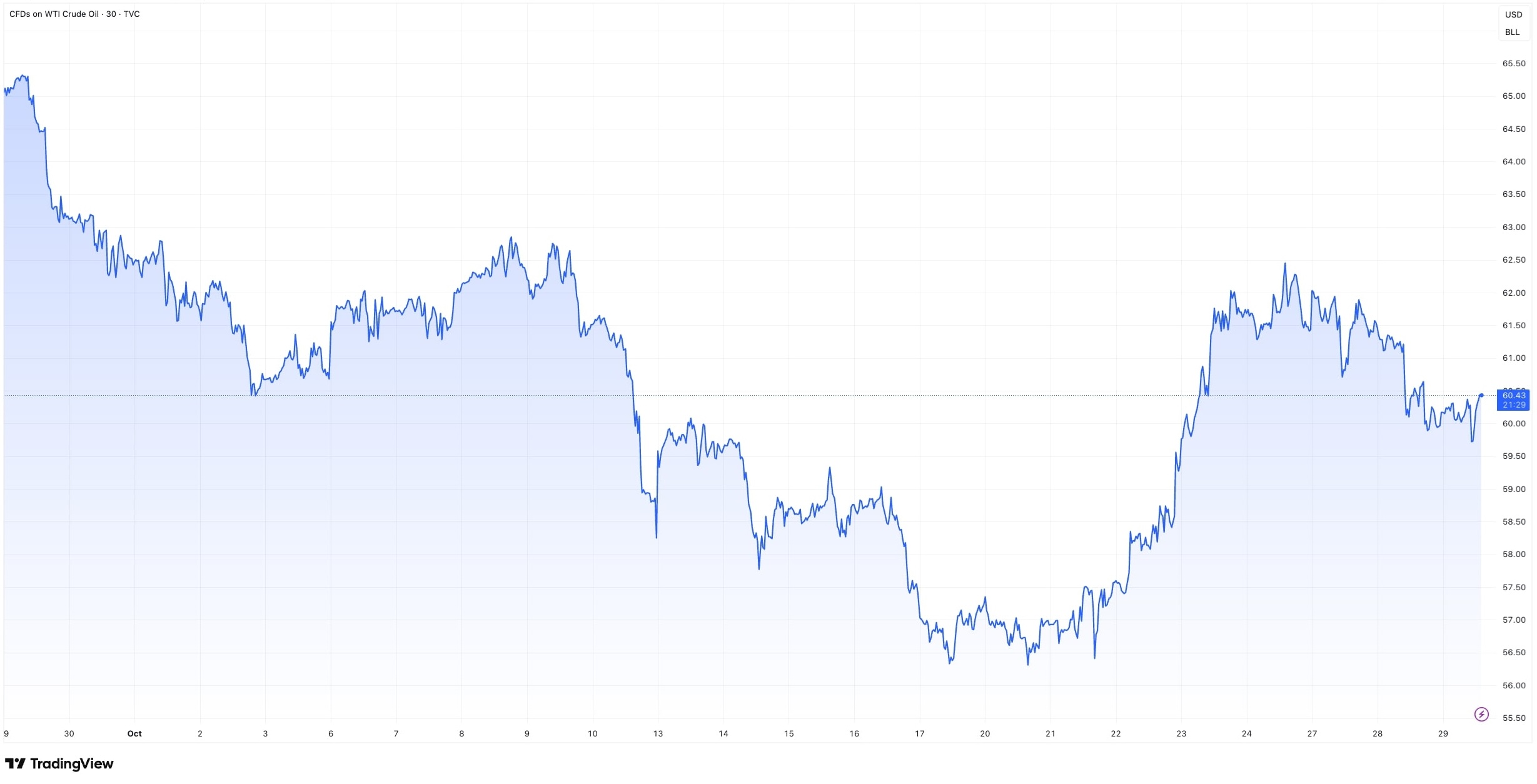

The diplomatic thaw is having ripple effects in energy markets as well. Oil prices rose on Wednesday amid optimism over the U.S.-China summit. The two nations are the world's largest oil consumers.

Brent and WTI crude last week logged their biggest weekly gains since June after Donald Trump imposed sanctions on Russia for the first time in his second term, targeting major oil companies.

Even so, doubts that the sanctions will offset global oversupply — and speculation about a potential OPEC+ output increase — have tempered gains. Both benchmarks fell 1.9%, or more than $1, in the previous session. The Kremlin responded by saying Russia continues to offer “top-quality energy at a good price,” adding that its partners can decide for themselves whether to purchase its oil following the new U.S. sanctions.