Thacker Pass vs. Nevada North: Why Surge Battery Metals ( $NILI / $NILIF ) Looks Like the Smarter Bet

-Visual chart located at bottom of article-

The lithium story in Nevada is one of scale, speed, and timing, and two names dominate the conversation: Lithium Americas’ Thacker Pass and Surge Battery Metals’ Nevada North Lithium Project (NNLP).

Both projects operate under Nevada’s mining-friendly regulatory environment and within driving distance of Tesla's Nevada GIGA factory. Both target claystone deposits. But they couldn’t be more different in execution, and the investment upside, in my opinion, leans heavily toward Surge Battery Metals (TSXV: $NILI / OTC: $NILIF ).

The lithium industry is steadily shifting toward clay-based extraction as technology catches up to the resource. Unlike hard-rock or brine operations, clay deposits can be processed on shorter timelines with lower environmental impact. Clay lithium is poised to become the dominant source for North American supply, cheaper, cleaner, and significantly faster from mine to battery.

1. The Heavyweight vs. the High-Flyer

Thacker Pass is Lithium Americas’ flagship, a billion-dollar giant backed by General Motors and a US $2.26 billion DOE loan. It’s the poster child for large-scale U.S. lithium development and will eventually anchor domestic supply.

NNLP’s shallow, high-grade zones and smaller initial footprint could translate into simpler access and lower costs.

And here’s the real advantage: Surge gets to move faster because the heavy lifting has already been done. Thacker Pass spent years proving the claystone model, the permitting pathways, and the extraction potential. NNLP now benefits from that groundwork, the second-mover advantage, advancing a high-grade discovery without having to fight the same uphill battles.

2. The Metrics That Matter

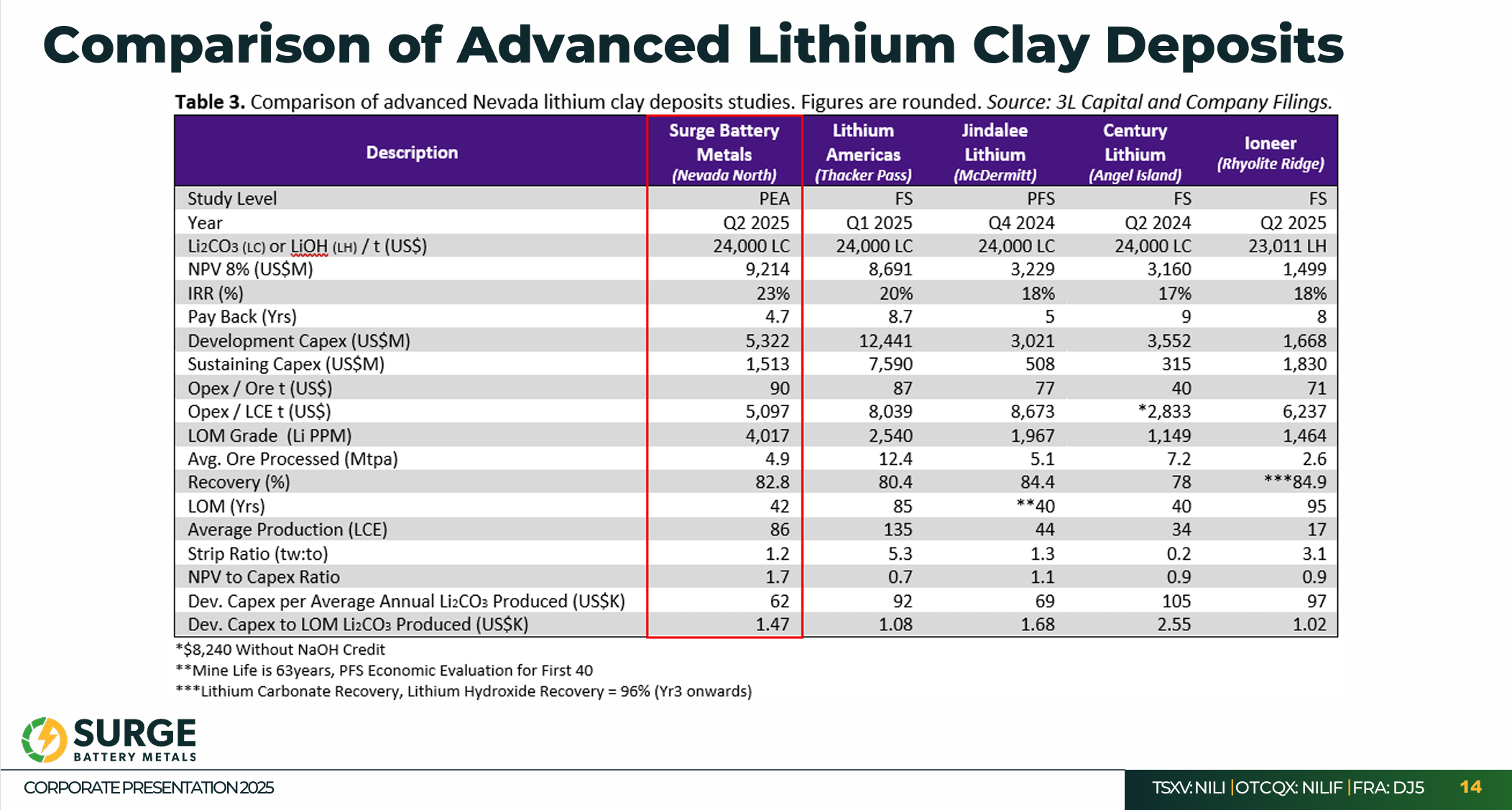

Surge’s PEA (Preliminary Economic Assessment) delivered some eyebrow-raising figures:

After-tax NPV₈%: US $ 9.21 billion

After-tax IRR: 22.8%

OPEX: ≈ US $ 5,097 / t LCE

Payback: 4.7 years

Compared to Thacker Pass, that’s roughly 37% lower operating costs and significantly higher grades.

If lithium prices pull back, those numbers make the difference between staying profitable and going underwater.

3. Timing Is Everything

Lithium Americas has already entered the industrial-scale build-out phase. Great for the industry, but the window for investor leverage is mostly closed.

Surge, by contrast, is still in the discovery-to-development sweet spot. Each step along the projected path has the potential to move the valuation meaningfully.

They’ve already brought in top-tier advisors, secured strong geological results, and are working toward upgrading resources to measured and indicated, the bridge to feasibility and real financing discussions.

The upcoming JV with $20B+ industry giant, Evolution Mining, could be the catalyst that completes the picture. Giving the project major-league credibility and unlocking access to government-backed funding and investment programs.

In preparation, Surge has brought in Cassidy & Associates, one of D.C.’s top government relations firms, to help navigate U.S. funding programs and accelerate government support for the Nevada North project.

Surge Battery Metals has also secured a major strategic investor, Quaternary Group, bringing both industry expertise and institutional credibility to the table as the Nevada North Lithium Project advances toward feasibility.

With a $9.2 Billion USD NPV before adding the data from the current 9 hole drill program. Everyone is wondering how this project is still sitting at *roughly $86 million CAD market cap when the upside is enormous? (*market cap estimate as of Oct, 29, 2025)

With the LOI outlining key joint venture terms and the exclusivity period remains until November 21, a binding JV announcement appears imminent, a potential near-term catalyst for the company.

All nine holes encountered significant thicknesses of the target lithium-bearing claystone horizons, visually consistent with high-grade mineralization observed in previous campaigns

When combined with upcoming infill drill results, it’s easy to see why the company’s current low market cap may not last much longer.

4. The Risk / Reward Trade

Let’s call it what it is: Thacker Pass is the safe blue-chip bet. NNLP is the growth story with asymmetric upside.

If Surge executes on its next steps, the re-rating potential is massive. Investors who position before that inflection point stand to gain the most.

5. Final Take

Thacker Pass will likely be the first U.S. lithium mine into production.

Nevada North could be the next one to surprise the market.

High grade, lower cost, shorter payback, and a clean runway to development, Surge Battery Metals isn’t just another lithium junior. It’s shaping up to be the most efficient lithium project in Nevada.

Sometimes the smarter play isn’t the biggest one, it’s the one that’s still early enough to grow.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The author may hold positions in the companies mentioned. Accuracy of information is not guaranteed, recommended to verify information.